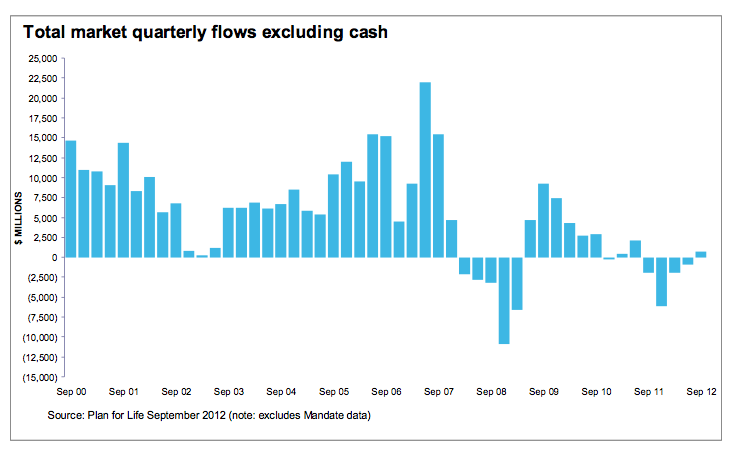

Another interesting discussion from the Perpetual Limited, Management’s Discussion and Analysis of Financial Condition and Results of Operations (MD&A) for the six months ended 31 December 2012 included the summary of Australian Funds Management Flows from 2000 to 2012

‘Based on September 2012 Plan for Life data, the Australian funds management industry has been in net cumulative outflow over the previous 12 months.

As can be seen from the following chart, there does appear to be some sign of improvement as each of the last three reported quarters have recorded an improvement in net flows over the prior period, with the September 2012 quarter recording its first quarter of net inflows since June 2011.

Inflows continue to remain well below pre Global Financial Crisis levels.

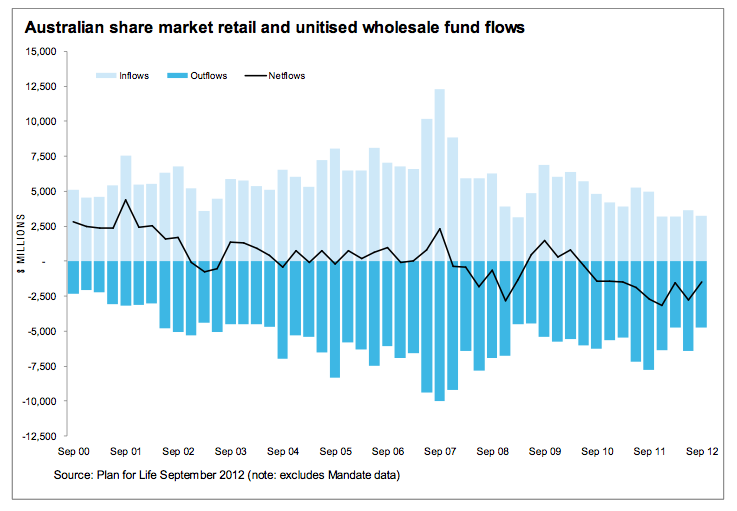

A similar trend can be seen in the following chart, which focuses on Australian share market ‘retail’ and unitised ‘wholesale’ fund flows.

Over the previous 12 months, outflows have improved and inflows remained steady.’